Understanding how interest rates work on car loans is important when buying a new or used car. Interest is what the lender charges you for borrowing money. It’s added to the price of the car and can make a big difference in how much you pay over time. Whether you’re getting your first car or thinking about refinancing, knowing how it all works can help you save money.

In this guide, we’ll break down how interest rates work on car loans in simple terms. We’ll also talk about what affects your rate, how to find the best car loan rates, and how to figure out what you’ll actually pay.

What Is an Interest Rate on a Car Loan?

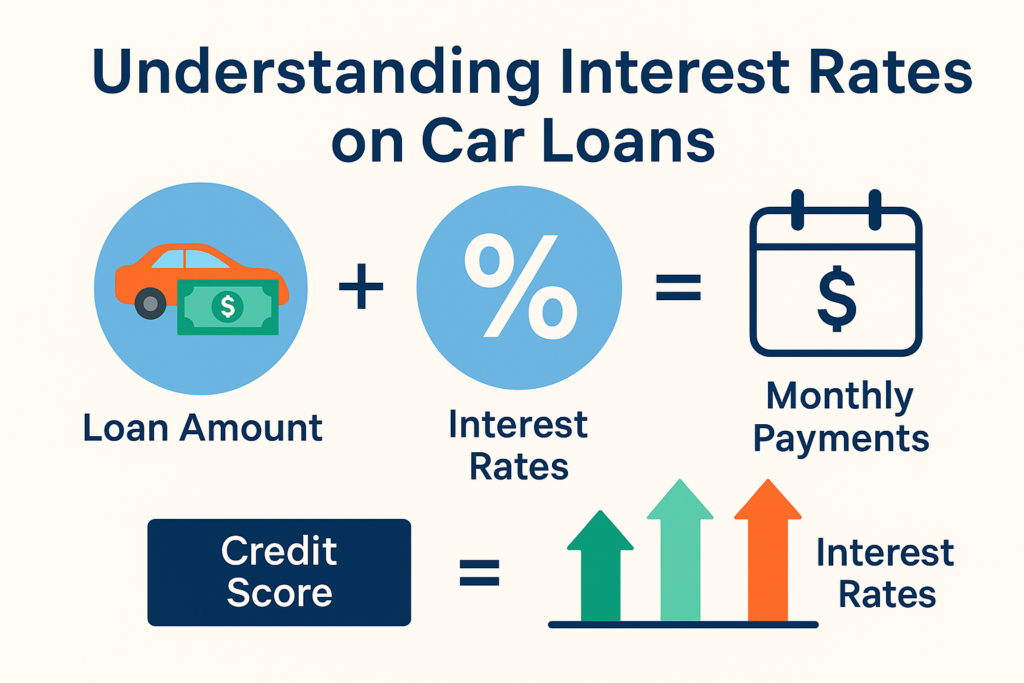

An interest rate is the cost you pay to borrow money. When you take out a car loan, the lender charges you interest as a fee. This is usually shown as a percentage. For example, if you get a $10,000 car loan with a 6% interest rate, you’ll pay extra money on top of the $10,000. That’s how interest rates work on car loans.

You might be wondering, how does interest rate on a car loan work? It works by adding a certain amount to your monthly payment based on your loan balance and interest rate. Over time, this adds up.

How Does Interest Rate Work on Car Loans?

So, how does interest rate work on car loans exactly? Here’s a simple way to understand it. Let’s say your car loan is $15,000, and your interest rate is 5%. That means you’ll pay 5% of that amount (divided across the loan term) as interest. This is usually included in your monthly payments.

Your lender calculates this amount based on your credit score, the car’s age, the loan term, and more. If your credit score is high, you may qualify for the best car loan rates. If it’s low, your rate could be higher.

Want to know how to work out interest rate on car loan? You can try this EMI calculator that helps you figure out exactly what you’ll pay, based on your interest rate and loan amount.

What Affects Car Loan Interest Rates?

Several things affect car loan interest rates. Lenders look at your credit score, income, and even the car itself. Here’s a breakdown:

-

Credit Score: The better your score, the lower your rate. Auto loan interest rates by credit score vary a lot. A score over 750 might get you 4-5%, while a score under 600 could mean 10% or more.

-

New vs. Used Car: Used car loan rates are often higher than new car rates.

-

Loan Term: A longer loan (like 72 months) may have a higher rate than a shorter one (like 36 months).

-

Down Payment: The more money you put down, the lower your risk to the lender, which could mean better rates.

-

Market Conditions: Current auto loan rates can rise or fall based on the economy and Federal Reserve decisions.

Now you know a bit more about how interest rates work on car loans and what can change them.

Average Car Loan Interest Rate in 2025

Knowing the average car loan interest rate helps you compare offers. In early 2025, the average rate for a new car loan is around 6.5%, while used car loan rates are closer to 8%. These numbers can change often, so it’s smart to shop around.

Also, don’t forget to check auto loan refinance rates if you already have a loan. If your credit score has improved, refinancing could save you hundreds or even thousands of dollars over the life of the loan.

Remember, how does the interest rate on a car loan work can feel confusing, but once you understand these basics, you can make better decisions.

Tips to Get the Best Car Loan Rates

Now that we’ve answered how does interest rates work on car loans, here are some quick tips to get a better deal:

-

Improve Your Credit Score: Even a small bump can lower your rate.

-

Get Pre-Approved: Auto loan pre-approval gives you a clearer idea of what rate you qualify for.

-

Compare Offers: Always check rates from banks, credit unions, and online lenders.

-

Negotiate: Some lenders may offer better deals if you ask.

-

Shorter Loan Terms: Short terms usually mean less interest.

Still unsure how does the interest rate on a car loan work in your case? Use online tools or talk to a loan expert for help.

Final Thoughts

So, how interest rates work on car loans doesn’t have to be a mystery. It’s all about understanding how lenders calculate what you owe, and what you can do to lower it. Whether you’re buying new, used, or thinking about refinancing, knowing how does interest rate on a car loan work can help you make smarter money choices.

Take time to compare auto loan rates, check your credit, and use a calculator to understand your payments. Learning how does interest rate work on car loans can save you from paying more than you need to.

If you’re still curious about how much your payments will be, check out this handy tool: How to Calculate EMI for Car Loan with Interest Rate