Buying a car is a big step, and most people need a loan to afford it. That’s where understanding how to calculate EMI for car loan with interest rate becomes important. Knowing your EMI (Equated Monthly Installment) helps you plan your monthly budget and choose the right car loan for your needs. This guide will walk you through the process in simple steps.

What Is EMI and Why It Matters

EMI stands for Equated Monthly Installment. It’s the fixed amount you pay each month to repay your car loan. Each EMI includes two parts: the loan amount (also called the principal) and the car loan interest rate. Over time, you pay off both through regular monthly payments.

Learning how to calculate EMI for car loan with interest rate helps you avoid financial stress and understand exactly how much your loan will cost over time.

Formula to Calculate EMI for Car Loan

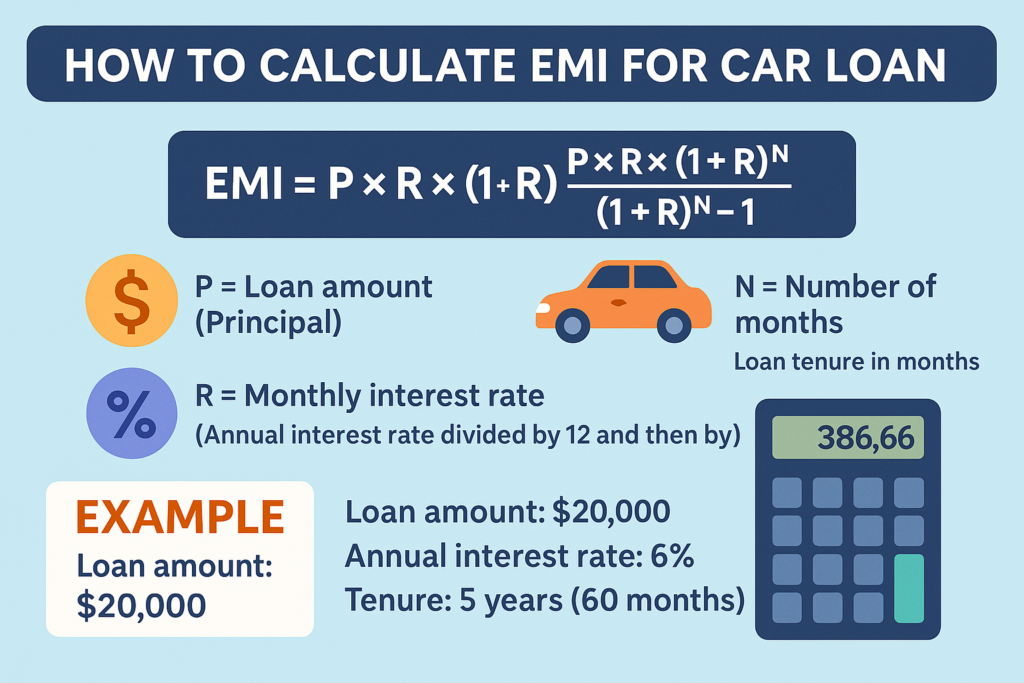

You can use a basic formula to calculate your EMI:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

-

P = Loan amount (Principal)

-

R = Monthly interest rate (Annual interest rate divided by 12 and then by 100)

-

N = Number of months (Loan tenure in months)

Let’s break it down with an example:

-

Loan amount: $20,000

-

Annual car loan interest rate: 6%

-

Tenure: 5 years (60 months)

Monthly interest = 6 / 12 / 100 = 0.005 Now plug it into the formula to get your EMI.

Simplify with an Online Calculator

Doing the math manually can be confusing. Instead, use a tool like a Car loan calculator. It’s quick, easy, and gives accurate results. Just enter your loan amount, interest rate, and tenure, and it will show you your EMI instantly.

This is the easiest way to learn how to calculate EMI for car loan with interest rate without making any mistakes.

What is a Car Loan Interest Rate?

The car loan interest rate is the extra percentage you pay the bank or lender for giving you the loan. It depends on several factors, including your credit score, income, loan amount, and the bank’s policies.

Interest rates can be fixed or floating. Fixed means it stays the same for the entire loan period. Floating means it can change based on the market. Always check which type you’re getting before you sign.

How Interest Rate Affects Your EMI

The car loan interest rate has a big effect on your monthly EMI. A higher interest rate means you’ll pay more every month. A lower rate means smaller EMIs and less total interest paid over time.

For example:

-

$25,000 loan for 5 years at 6% = EMI around $483

-

At 5% interest, the EMI drops to around $472

That’s a savings of $11 per month, or $660 over the full loan period. That’s why it’s important to know how to calculate EMI for car loan with interest rate before agreeing to a loan.

Factors That Affect EMI Calculations

Several things affect how your EMI is calculated:

-

Loan Amount – Higher loans mean higher EMIs

-

Car Loan Interest Rate – Higher rates increase your monthly cost

-

Loan Tenure – Longer loans reduce EMIs but increase total interest

-

Down Payment – Paying more upfront lowers the loan amount

-

Credit Score – A good score can help you get lower interest rates

All these factors combine when figuring out how to calculate EMI for car loan with interest rate.

Real-Life Example of EMI Calculation

Let’s say you are taking a car loan of $30,000 with a 6% annual interest rate for 6 years. Here’s how to calculate:

-

Monthly interest rate = 0.005 (6/12/100)

-

Number of months = 72 Using the formula: EMI ≈ $500

Using an online Car loan calculator will give you this result within seconds.

Tips to Lower Your Car Loan EMI

If you’re looking for ways to reduce your EMI, try these tips:

-

Make a higher down payment to lower the loan amount.

-

Choose a longer repayment period to reduce monthly payments.

-

Compare lenders to find the lowest car loan interest rate.

-

Improve your credit score before applying.

-

Negotiate with banks if you have a strong financial background.

Knowing how to calculate EMI for car loan with interest rate can help you choose smarter and save more.

Comparing Interest Rates from Different Lenders

Let’s take a look at common interest rates offered by popular U.S. lenders:

LenderInterest Rate (Approx)FeaturesBank of America5.49% – 6.99%Discounts for auto-pay customersCapital One5.79% – 7.99%Flexible terms, easy applicationWells Fargo6.25% – 8.00%Fixed APRs, strong customer supportChase Auto5.99% – 7.75%Prequalification available

When comparing, use a Car loan calculator for each lender to find the best deal.

When Should You Take a Car Loan?

Take a car loan only when you’re sure you can afford the EMI every month. Make sure your other expenses like rent, food, and savings are not affected. Use the calculator to test different combinations before deciding.

Understanding how to calculate EMI for car loan with interest rate also helps you avoid overborrowing.

Summary

-

EMI includes both the loan amount and car loan interest rate.

-

Use the EMI formula or a Car loan calculator to estimate monthly payments.

-

Compare interest rates from different banks before choosing.

-

Factors like credit score, tenure, and down payment affect your EMI.

-

Learn how to calculate EMI for car loan with interest rate to make better financial choices.

Final Thoughts

Now that you know how to calculate EMI for car loan with interest rate, you’re ready to make smarter decisions about your car purchase. Using a tool like a Car loan calculator gives you a clear picture of what to expect and helps you stay within your budget.

Always remember to check your interest rate, compare offers, and understand all loan terms before agreeing. With the right knowledge, getting a car loan can be simple and stress-free.