When searching for an apartment, you might come across two terms: net effective rent and gross rent. These terms can be confusing, especially if you’re not familiar with how rental pricing works. Understanding the difference between net effective rent vs gross rent in apartment leases can help you make smarter rental decisions and avoid surprises later.

In this article, we’ll break down these terms in simple words, explain how they’re calculated, and show you real-world examples. We’ll also answer common questions like “Do you pay net effective rent or gross rent?” and provide tools like a net effective rent vs gross rent calculator.

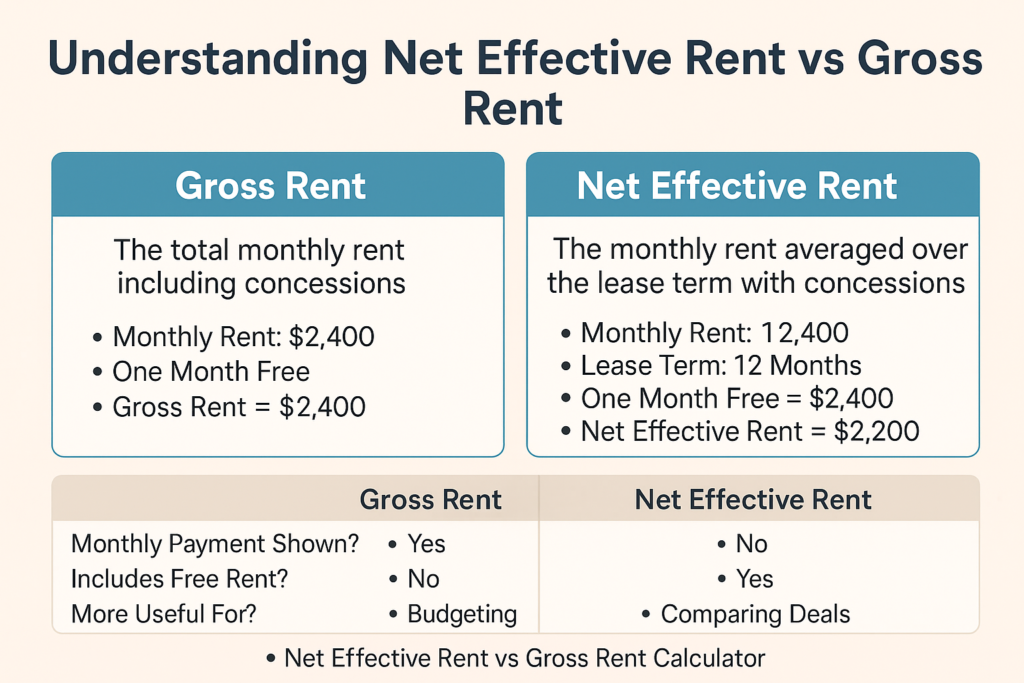

What Is Gross Rent?

Gross rent is the total amount you pay your landlord each month. It includes your base rent plus any extra costs, such as utilities, maintenance fees, or parking. This is the actual amount you are expected to pay every month.

For example, if your rent is $2,000 and your landlord includes $100 for utilities and $50 for parking, your gross rent is $2,150.

Gross Rent Example:

-

Base Rent: $2,000

-

Utilities: $100

-

Parking: $50

-

Gross Rent = $2,150

When comparing apartments, always ask what the gross rent is. It shows the full cost you’ll pay monthly.

What Is Net Effective Rent?

Net effective rent is a marketing tool used by landlords to advertise a lower monthly cost. It’s calculated by taking the total rent over the lease term and subtracting any free rent or discounts, then dividing that by the number of months in the lease.

For instance, if your rent is $2,400/month and you get one month free on a 12-month lease, the net effective rent is lower.

Net Effective Rent vs Gross Rent Example:

-

Monthly Rent: $2,400

-

Lease Term: 12 Months

-

One Month Free = $2,400 savings

-

Total Paid: $2,400 x 11 = $26,400

-

Net Effective Rent = $26,400 ÷ 12 = $2,200

So, your net effective rent would be $2,200, but you still pay $2,400 every month—except the one free month.

What Is the Net Effective Price?

The net effective price is the reduced cost you’re paying on average per month after any concessions. It helps you compare rental deals fairly, especially when promotions are involved.

Landlords might advertise the net effective rent to make a unit seem cheaper. Always ask, “Do I pay net effective rent or gross rent?” The answer is: you pay the gross rent unless the free month is factored in monthly by the landlord, which is rare.

What Is Effective Rent?

Effective rent is just another way to describe net effective rent. It reflects the average rent you’re paying after discounts or free months are applied.

It’s useful for budgeting and comparing offers. But remember, the monthly check you write is based on the gross rent, not the net.

Net Rent vs Gross Rent

The difference between net rent and gross rent is simple. Net rent only includes the base rent, while gross rent includes everything (utilities, fees, etc.).

For example:

-

Net Rent: $1,800 (just rent)

-

Gross Rent: $2,000 (rent + $200 utilities)

This is very important in both residential and gross rent vs net rent commercial leases, where terms can vary widely.

How to Calculate Gross Rent

To figure out your gross rent, just add up the base rent and any other monthly costs. Here’s how:

Gross Rent = Base Rent + Utilities + Fees + Other Charges

Let’s say:

-

Base Rent: $2,000

-

Water & Trash: $50

-

Parking: $75

-

Gross Rent = $2,125

This is the total amount you’ll pay each month.

Net Effective vs Gross Rent: Which Matters More?

Both are important but for different reasons.

-

Gross Rent shows what you’ll pay monthly.

-

Net Effective Rent helps you compare deals.

For budgeting, focus on gross rent. For comparing offers from different buildings (especially ones with move-in deals), look at net effective rent.

Gross Rent vs Base Rent

Base rent is just the rent for the space itself. Gross rent includes everything else—like garbage collection, internet, or gym fees.

So if an ad says base rent is $1,900, you might end up paying $2,050 gross rent once everything is added.

Gross Effective Rent

Gross effective rent is sometimes used in commercial real estate. It refers to the total income a landlord receives from a property, adjusted for concessions. It’s similar to net effective rent but used from the owner’s point of view.

What Is the Effective Gross Rent Multiplier?

The effective gross rent multiplier (EGRM) is a number used by investors to see how valuable a rental property is.

It’s calculated like this:

EGRM = Property Price ÷ Effective Gross Rent

This shows how many years it would take for rent income to match the purchase price. Lower numbers mean a better investment.

Net Effective Rent Calculator

You can use a net effective rent calculator online or do it manually:

Step 1: Multiply gross rent by lease length

Step 2: Subtract discounts or free rent

Step 3: Divide by the number of months

Example:

-

Rent: $3,000/month

-

12-month lease, 2 months free

-

You pay: $3,000 x 10 = $30,000

-

Net Effective Rent = $30,000 ÷ 12 = $2,500

Net Effective Rent vs Gross Rent Calculator

Want to compare two listings? Use a net effective rent vs gross rent calculator. Just input:

-

Base Rent

-

Lease Term

-

Any Discounts

-

Added Fees

The tool will show you both the gross and net effective rents, so you know the true value of each offer.

Which One Do You Actually Pay?

Let’s clear up the biggest question: Do you pay net effective rent or gross rent?

Answer: You almost always pay the gross rent. The net effective rent is for marketing and comparison. Unless the landlord spreads the discount across each month, your monthly payment is the full amount.

So, even if the ad says “Only $2,100/month!”, you might end up paying $2,400 each month and just get one or two months free.

Summary Net Effective Rent vs Gross Rent

Here’s a simple breakdown of the difference between net effective rent vs gross rent in apartment leases:

| Feature | Gross Rent | Net Effective Rent |

|---|---|---|

| Monthly Payment Shown? | Yes | No (Average Only) |

| Includes Free Rent? | No | Yes |

| Used for Marketing? | Rarely | Frequently |

| Useful for Budgeting? | Yes | Only for comparing deals |

| What You Actually Pay? | Gross Rent | Not the net amount |

Final Thoughts

Understanding the difference between net effective rent vs gross rent in apartment leases helps you avoid surprises and make better financial choices. Gross rent tells you what you’ll actually pay. Net effective rent helps you compare promotional offers.

So next time you’re apartment hunting, ask questions like:

-

“Is this the gross rent or net effective rent?”

-

“How many free months are included?”

-

“What’s the total I pay each month?”

With this knowledge and the help of a net effective rent calculator, you’ll be better equipped to find a lease that fits your budget and expectations.