What is Net Effective Rent and How to Calculate It Accurately

When searching for an apartment, you may come across the term net effective rent. This is a pricing strategy often used by landlords and property managers to make rental listings look more affordable. But what does it really mean? And how can you make sure you’re doing the math right?

In this article, we’ll break down what net effective rent is and how to calculate it accurately. We’ll also look at why landlords use it, what it means for your monthly payments, and how to avoid confusion when comparing rental options.

What is Net Effective Rent?

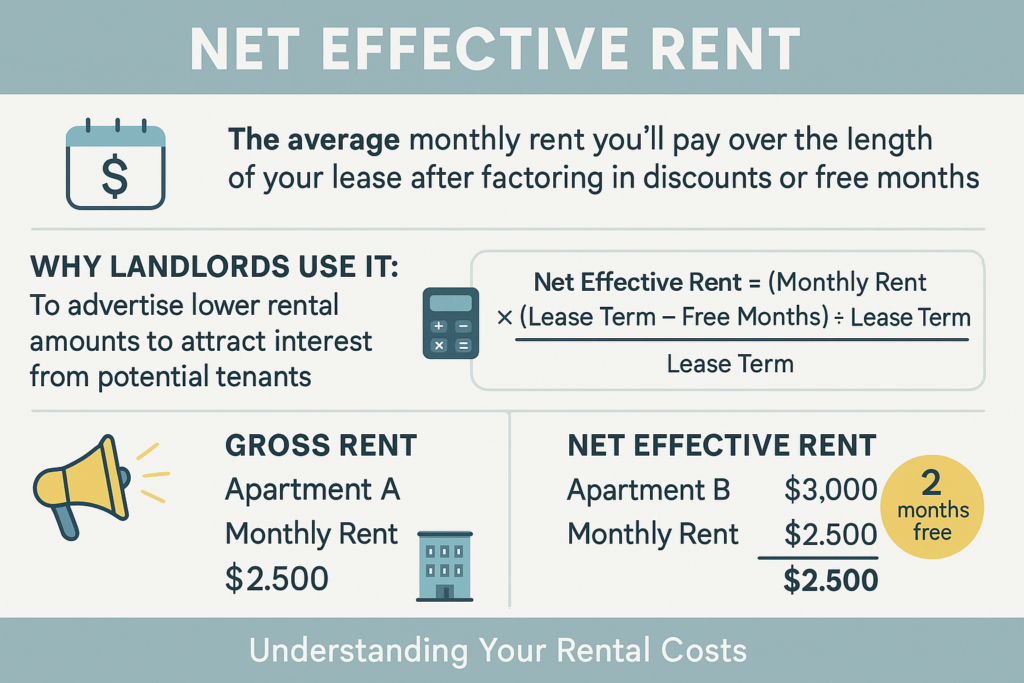

Net effective rent is the average monthly rent you’ll pay over the length of your lease, factoring in any discounts, free months, or special offers. Instead of just showing the actual monthly payment, landlords use net effective rent to advertise a lower amount that reflects these deals.

For example, a landlord might offer one month free on a 12-month lease. Even though you’re only paying for 11 months, you’re still living there for a full year. Net effective rent spreads out that free month across the lease to show a reduced average rent.

Why Do Landlords Use Net Effective Rent?

Landlords and property managers often use net effective rent to make their listings more appealing. By showing a lower price, they can attract more interest, especially in competitive rental markets.

It’s a common marketing tool used during slower seasons or when a property has been vacant for a while. Offering a free month or a rent discount can make a big difference in attracting tenants quickly.

How to Calculate Net Effective Rent Accurately

Let’s walk through how to calculate net effective rent in a simple way. You only need three things: total rent paid, number of free months, and lease length.

Here’s the basic formula:

Net Effective Rent = (Monthly Rent × (Lease Term – Free Months)) ÷ Lease Term

Let’s say your monthly rent is $2,400, and the landlord is offering one month free on a 12-month lease.

Here’s how you’d calculate it:

($2,400 × 11) ÷ 12 = $2,200

So, while you’ll actually pay $2,400 per month for 11 months, your net effective rent is $2,200. This is what the landlord may advertise in the listing.

Want to skip the math? Use this handy Net Effective Rent Calculator to crunch the numbers quickly and accurately.

What’s the Difference Between Net Effective Rent and Gross Rent?

This is one of the most common questions renters have. Gross rent is the actual monthly amount you pay—what you’ll see on your rent bill each month. Net effective rent, on the other hand, includes any specials or discounts averaged out across your lease.

Let’s break it down:

-

Gross Rent: The real monthly rent you pay (e.g., $2,400).

-

Net Effective Rent: The average monthly rent after discounts (e.g., $2,200 with one month free).

It’s easy to confuse the two. Always ask which one is being advertised so you can budget properly. When in doubt, calculate both to compare listings more accurately. That way, you’ll understand what net effective rent is and how to calculate it accurately in the context of your budget.

Real-Life Example: Net Effective Rent vs. Monthly Payment

Imagine you’re looking at two listings:

-

Apartment A: $2,400/month with one month free on a 12-month lease.

-

Apartment B: $2,200/month with no discounts.

At first glance, Apartment B looks cheaper. But let’s use the formula to find the net effective rent of Apartment A:

($2,400 × 11) ÷ 12 = $2,200

In this case, both apartments cost the same over the year. But remember, for Apartment A, you’ll need to pay $2,400 per month (except for the free month). So while the net effective rent is the same, the payment structure is different.

This shows why it’s important to understand what net effective rent is and how to calculate it accurately, especially when budgeting monthly expenses.

Common Mistakes When Calculating Net Effective Rent

When learning what net effective rent is and how to calculate it accurately, many renters make simple errors. Here are a few things to avoid:

-

Confusing gross rent with net rent – Don’t assume the advertised price is what you’ll actually pay each month.

-

Ignoring lease length – A longer lease may come with more incentives, but always do the math.

-

Forgetting about upfront costs – First month, last month, and security deposits can impact your overall costs.

-

Not verifying the terms – Always confirm how many months are free and whether they’re at the beginning, end, or spread out.

-

Overlooking recurring fees – Some apartments include parking, utilities, or amenities. These affect your total cost.

When Should You Use Net Effective Rent?

Use net effective rent when comparing apartments with special offers. It helps you evaluate which option gives you more value over time. However, if you’re more concerned with your actual monthly payments, focus on gross rent instead.

Landlords may not always explain it clearly, so it’s smart to ask direct questions:

-

“Is this the net effective rent or the actual monthly payment?”

-

“Are any months free, and when do they apply?”

-

“Is the discount spread over the lease or given upfront?”

Final Thoughts

Knowing what net effective rent is and how to calculate it accurately gives you a serious advantage in today’s rental market. It allows you to compare listings fairly, plan your budget wisely, and avoid common pitfalls.

Always look beyond the price in the listing. Take a few minutes to run the numbers yourself. Use the formula, ask questions, and make sure the apartment fits both your needs and your budget.

Whether you’re a first-time renter or just moving to a new city, understanding net effective rent can save you money and a lot of stress.